In this article, we will discuss the formula for predetermined overhead rate and how to calculate it. The formula for calculating predetermined overhead rate is estimated overhead divided by the allocation base. Calculation of predetermined overhead rates enables manufacturers to set product prices that accurately reflect the production costs, safeguarding profit margins.

The Importance of Accurate Overhead Rate Calculation

While it may become more complex to have different rates for each department, it is still considered more accurate and helpful because the level of efficiency and precision increases. The AI assistant not only provides the numerical output directly in the spreadsheet but also explains the calculation process through its interactive chat interface. This dual-display capability ensures you not only receive the answers you need but also understand the methodology behind them. For a deeper understanding of pricing strategies, check out our resource on identifying pricing strategies. Cut unnecessary spending – Review budgets to identify and eliminate expenses that do not contribute real business value. A bookkeeping expert will contact you during business hours to discuss your needs.

How to calculate the predetermined overhead rate

- If you have a company related to manufacturing, or you work as an accountant for such a business, it’s essential to calculate and monitor the predetermined overhead rate.

- While it may become more complex to have different rates for each department, it is still considered more accurate and helpful because the level of efficiency and precision increases.

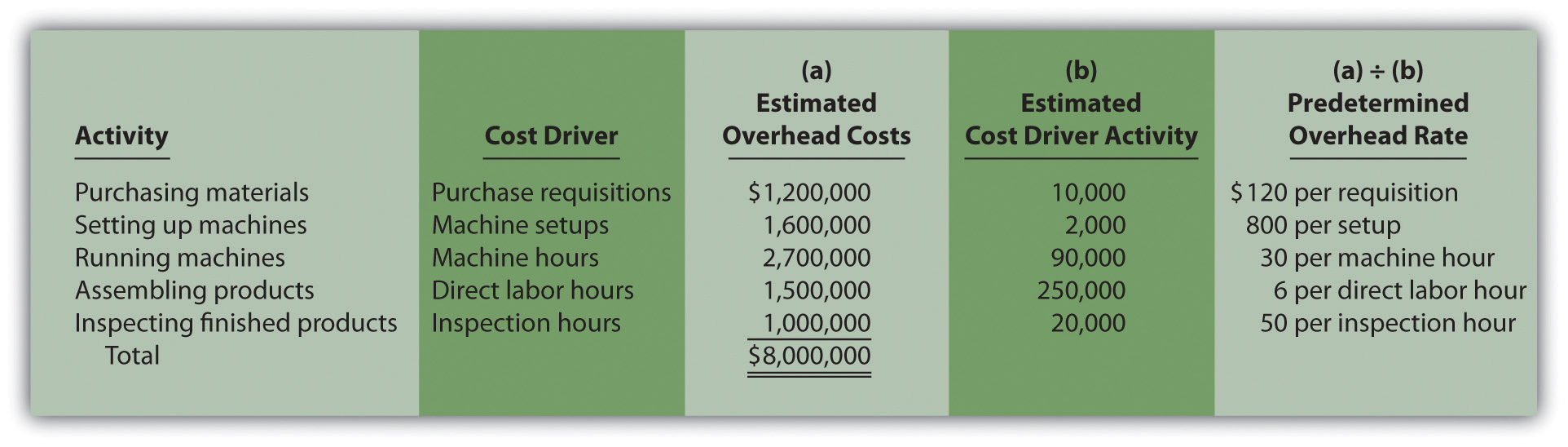

- To calculate a predetermined overhead rate, divide the manufacturing overhead cost by the units of allocation.

- This rate, calculated as total estimated overhead costs / total estimated allocation base, helps businesses in allocating overhead costs more precisely.

- The overhead cost per unit from Figure 6.4 is combined with the direct material and direct labor costs as shown in Figure 6.3 to compute the total cost per unit as shown in Figure 6.5.

- The period selected tends to be one year, and you can use direct labor costs, hours, machine hours or prime cost as the allocation base.

A high overhead rate can indicate that you need to control your costs better or raise your prices. On the other hand, a low overhead rate might show that you are operating efficiently. Optimize processes – Streamline workflows around everything from inventory to invoicing to save time and cut labor costs. Implementation of ABC requires identification and record maintenance for various overheads. This record maintenance and cost monitoring is expected to increase the administrative cost.

Overhead Rate Formula: A Comprehensive Guide

Predetermined overhead rates help organizations in crafting comprehensive budgets that incorporate both direct and indirect costs, and in setting financial targets and performance benchmarks. To calculate total overhead cost, list all indirect costs over a specific time period and add them together. It helps you understand how much you spend on operating your business beyond direct costs. Knowing this can help you set prices that cover all costs and make a profit. This guide will walk you through the steps to calculate your overhead rate.

Therefore, the predetermined overhead rate of GHJ Ltd for next year is expected to be $5,000 per machine hour. To calculate a predetermined overhead rate, divide the manufacturing overhead cost by the units of allocation. As previously mentioned, the predetermined overhead rate is a way of estimating the costs that will be incurred throughout the manufacturing process. That means it represents an estimate of the costs of producing a product or carrying out a job.

Divide budgeted overheads with the level of activity

GoCardless is a global payments solution that helps you automate payment collection, cutting down on the amount of financial admin your team needs to deal with. Obotu has 2+years of professional experience in the business and finance sector. Her expertise lies in marketing, economics, finance, biology, and literature. She enjoys writing in these fields to educate and share her wealth of knowledge and experience. Sourcetable is the optimal tool for anyone looking to enhance their efficiency and accuracy in financial analysis or academic learning.

It’s called predetermined because both of the figures used in the process are budgeted. It’s also important to note that budgeted figures in calculating overhead rates are used due to seasonal fluctuation/expected changes in the external environment. The business has to incur different types of expenses for the manufacturing of the products. These expenses include direct material, direct labour, direct overheads, and indirect overheads etc.

Let’s understand the detailed perspective of the concept along with steps. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most bank reconciliation definition and example of bank reconciliation major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.